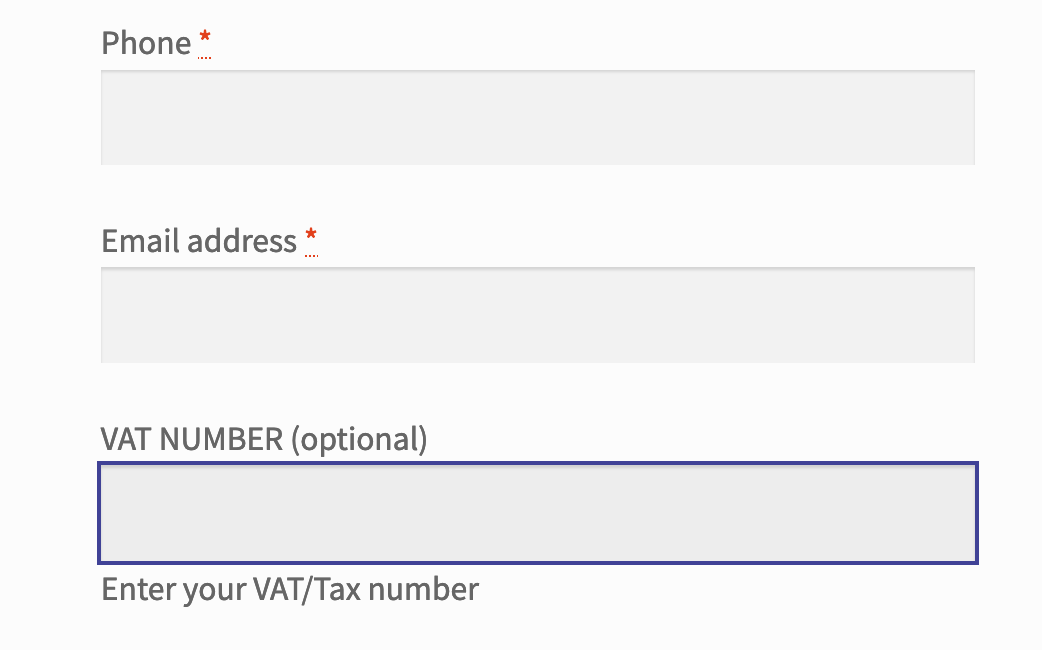

- Collect and validate EU VAT numbers at Checkout;

- Exempt businesses from paying VAT (Value Added Tax), if necessary;

- Collect and validate user location in B2C transactions;

- Handle EU Tax requirements for digital goods;

This extension provides your checkout with a field to collect and validate a customer’s EU VAT number if they have one. Upon entering a valid VAT number, the business will not be charged VAT at your store.

How does the VAT number validation work?

Will customers outside Europe see this field?

How to set up EU VAT rates for digital goods?

| DocumentationNeed guidance? Check out the comprehensive documentation to learn everything about you need to know about the EU VAT Number extension.View documentation |

* Version: 2.8.9

* Requires at least: 6.2

* Tested up to: 6.4

* WC requires at least: 8.1

* WC tested up to: 8.3

* Requires PHP: 7.3

*** EU VAT Number Changelog ***

2023-12-11 - version 2.8.9

* Dev - Add Playwright e2e tests for Critical Flows.

* Dev - Bump WooCommerce "tested up to" version 8.3.

* Dev - Bump WooCommerce minimum supported version to 8.1.

* Dev - Bump WordPress "tested up to" version 6.4.

* Dev - Bump WordPress minimum supported version to 6.2.

* Dev - Update PHPCS and PHPCompatibility GitHub Actions.

* Dev - Update default behaviour to use Cart and Checkout Blocks in e2e tests.

* Fix - Compatibility issues with the Checkout Block.

* Tweak - Admin settings colour to match admin theme colour scheme.

info: https://woocommerce.com/products/eu-vat-number/